GSFC Share Price Target is a type of stock traded in the stock market. In this article, we’ll talk about the company’s financial growth, its business policies, its shareholder structure, and the predicted share prices for each year. We’ve used expert data and analysis to understand GSFC Share Price Target. This article could be useful for those considering investing in this stock right now. Let’s delve into GSFC Share Price Target from 2024 to 2040.

If you’re thinking about which stock to invest in lately, you might want to consider looking into GSFC Share Price Target. In today’s blog, we’ll explain the basic idea behind GSFC Share Price Target for the years 2024, 2025, 2027, 2030, and 2040. We’ve done research and consulted with experts to provide insights into the company’s growth, performance, and more.

What Is GSFC Company?

GSFC stands for Gujarat State Fertilizer & Chemicals Limited. It’s a company that makes fertilizers and chemicals. It belongs to the Government of Gujarat and was started in 1962. GSFC’s main office is in Vadodara, Ahmedabad. GSFC is a government-owned company that focuses on making fertilizers and chemicals. It also produces other items like man-made fibers, plastics, and synthetic rubbers. Most of its money comes from selling fertilizers (70%), with the rest from industrial products (23%).

Gujarat Fluorochemicals Limited makes special chemicals like fluoropolymers and refrigerants. They’re really good at it and are the fifth biggest exporter of these chemicals in the world. Lots of industries use their stuff, like making cars, printing ink, and even medicine. In the future, they want to focus more on making chemicals for electric cars, solar power, and eco-friendly hydrogen.

Overview Of GSFC Company:

GSFC Company makes things like fertilizers and industrial products. Some of their fertilizers include Neem Urea, Di-Ammonium Phosphate, and Ammonium Phosphate. They also produce industrial items like Caprolactam, Nylon-6, Sulphuric Acid, and Cyclohexanone. Other industrial products they make are Ammonium Sulphate, Nitric Acid, Methanol, and Melamine Cyanurate. GSFC was the first company to build a fertilizer plant.

READ MORE: Suzlon share price target 2023, 2024, 2025, 2026, 2028, 2030

In the financial year 2021-22, the fertilizers that made the most money were diammonium phosphate, urea, and ammonium sulfate. These fertilizers brought in 60% of the revenue. An oil and gas refinery located in South Basin and Bombay High expanded, creating 8 new fertilizer plants in India. This expansion could help increase food availability in India. Here are some details about Gujarat State Fertilizer & Chemical Limited:

- Market Cap: ₹9,725.45 Crore

- P/B Ratio: 0.80

- Book Value: ₹310.12

- Face Value: ₹2

- 52 Week High: ₹322.25

- 52 Week Low: ₹146.15

- Dividend Yield: 4.43%

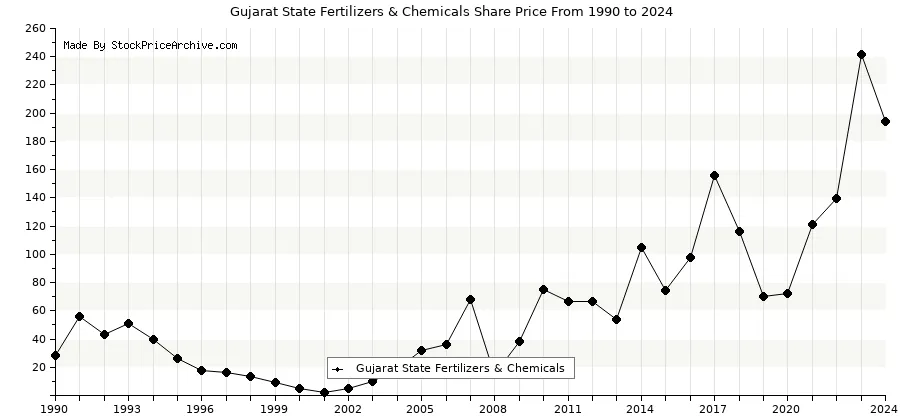

GSFC Share Price Growth Chart:

GSFC Share is traded on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) in India. It’s currently experiencing a positive trend in the stock market. Over the past six months, the share has grown by 68.50% (or 39.65%), over the past month by 28.80% (or 13.56%), in the last year by 118.10% (or 95.90%), over the last five years by 137.05% (or 131.53%), and its maximum growth reached +228.02% (or 1,723.51%).

Looking at the GSFC share price chart, the return amount in the last three months decreased by 14.56%, but over the last month, it increased by 12.1%. Over the past year, the return amount was 98.12%, over the last three years it was 181.23%, and over the last five years, it was 132.23%. GSFC Share consistently offers good returns to investors. Investing in this share for the long term can be beneficial.

READ MORE: What is Lingose Gamefi, Gaming Password ID | Lingose (LING) Price Prediction-2023 to 2050

GSFC Share Price Target 2024:

The GSFC company makes products that help farmers with food shortages and plant diseases. They create fertilizers like NPK 19-19-19, NPK 0-52-34, and NPK 13-0-45, which help plants grow better. They also make biofertilizers like Rhizobium Culture, which boosts crop yield.

In 2024, the GSFC share price target is set at ₹317.33 for the first target and ₹310.11 for the second target. The company’s profit has been growing steadily. Over the past 5 years, it increased by 23.25%. In the last 3 years, it jumped by 136.12%, but in the last year, it dropped to 45.23%. In March 2022, the net profit was ₹895.56 Crore, which increased to ₹1,356.56 Crore by March 2023. Profit from operations also rose from ₹1,456.23 Crore in March 2022 to ₹1,725.23 Crore in March 2023.

| 2024 | Target 1 | Target 2 |

| January | x | x |

| February | x | x |

| March | x | x |

| April | x | x |

| May | ₹271.56 | ₹288.45 |

| June | ₹285.11 | ₹291.80 |

| July | ₹293.55 | ₹295.32 |

| August | ₹300.32 | ₹297.76 |

| September | ₹306.90 | ₹300.54 |

| October | ₹310.14 | ₹303.87 |

| November | ₹314.54 | ₹307.52 |

| December | ₹317.33 | ₹310.11 |

The current trend of the share market is likely to remain the same in the future. Although some volatility may be seen, the company’s stock price may reach ₹307.83 per share by the end of Shortcuts.

GSFC Share Price Target 2025:

Recently, GSFC has become one of the top companies listed in Fortune India 500. Apart from its main business, GSFC also makes special seeds that grow well and resist diseases and pests. These seeds include Bajra, Paddy, Potato, and Wheat, which are sold under the brand name ‘sadar’. One of its products, Sadar Hybrid Bajara-3, can produce 3900 kilograms per hectare.

In Gujarat, GSFC sells its products through 45 area offices, regional offices, and over 200 markets and farm centers. Additionally, it has marketing offices in various cities like Lucknow, Meerut, Pune, Bhopal, Kolkata, Mumbai, Chennai, New Delhi, Bengaluru, and Kota.

The company’s stock price target for 2025 is set at ₹380.90 for the first target and ₹383.87 for the second target. GSFC has been experiencing rapid sales growth. Over the past 5 years, its sales have increased by 13.2%, which rose to 15.3% in the last 3 years, and last year it shot up to 26.2%. In March 2022, the company’s net sales were ₹8952.56 Crore, which increased to ₹11,896.56 Crore in March 2023.

| 2025 | Target 1 | Target 2 |

| January | ₹320,34 | ₹313.01 |

| February | ₹323.00 | ₹317.98 |

| March | ₹325.65 | ₹321.56 |

| April | ₹331.99 | ₹327.89 |

| May | ₹334.98 | ₹330.76 |

| June | ₹338.94 | ₹341.98 |

| July | ₹345.67 | ₹349.00 |

| August | ₹353.99 | ₹357.91 |

| September | ₹359.67 | ₹361.32 |

| October | ₹366.00 | ₹370.17 |

| November | ₹373.12 | ₹376.43 |

| December | ₹380.90 | ₹383.87 |

READ MORE: RVNL Share Price Target 2024, 2025, 2027, 2030 And 2035

GSFC Share Price Target 2026:

If the market remains bullish towards GSFC the first target is set to ₹442.71 and the second target is ₹446.32

| 2026 | Target 1 | Target 2 |

| January 2026 | ₹386.78 | ₹390,90 |

| February | ₹391.12 | ₹396.01 |

| March | ₹395.99 | ₹400.09 |

| April | ₹401.00 | ₹406.98 |

| May | ₹407.12 | ₹411.45 |

| June | ₹411.90 | ₹413.90 |

| July | ₹415.76 | ₹420.00 |

| August | ₹419.00 | ₹421.99 |

| September | ₹423.87 | ₹426.87 |

| October | ₹428.31 | ₹430.98 |

| November | ₹434.11 | ₹439.54 |

| December | ₹442.71 | ₹446.32 |

GSFC Share Price Target 2027:

The GSFC company is leading in using advanced biotechnology for agriculture. They make Agro Products for plant tissue culture, where small tissue grows into whole plants in special media. Their Banana Variety has high yield (15% to 20%) and no diseases. GSFC exports to over 30 countries like the UK, Germany, and the Netherlands.

Their share price target for 2027 is ₹407.98 for the first target and ₹511.43 for the second. Their revenue is growing. In March 2022, it was ₹9,123.23 Crore, and by March 2023, it increased to ₹12,456.56 Crore. Operation revenue also rose from ₹8,999.89 Crore in March 2022 to ₹11,456.89 Crore in March 2023.

| 2027 | Target 1 | Target 2 |

| January | ₹445.41 | ₹451.60 |

| February | ₹452.40 | ₹455.82 |

| March | ₹457.82 | ₹461.03 |

| April | ₹463.13 | ₹466.87 |

| May | ₹467.61 | ₹471.21 |

| June | ₹473.76 | ₹476.00 |

| July | ₹478.63 | ₹481.50 |

| August | ₹484.08 | ₹487.09 |

| September | ₹489.99 | ₹494.56 |

| October | ₹496.02 | ₹499.99 |

| November | ₹500.43 | ₹506.79 |

| December | ₹407.98 | ₹511.43 |

GSFC Share Price Target 2028:

If the current flow remains same the share price target at the end of the year 2028 may touch ₹464.15 and the second target is ₹563.08

| 2028 | Target 1 | Target 2 |

| January | ₹411.52 | ₹514.09 |

| February | ₹414.44 | ₹517.76 |

| March | ₹418.91 | ₹520.53 |

| April | ₹423.77 | ₹526.08 |

| May | ₹429.62 | ₹533.19 |

| June | ₹435.78 | ₹537.10 |

| July | ₹439.12 | ₹543.13 |

| August | ₹444.70 | ₹548.01 |

| September | ₹449.61 | ₹552.30 |

| October | ₹455.17 | ₹555.90 |

| November | ₹459.65 | ₹559.02 |

| December | ₹464.15 | ₹563.08 |

GSFC Share Price Target 2030:

GSFC Company has a large nursery spanning 8.94 lakh square meters to maintain a clean environment. They’ve established horticulture for their chemical plants. Since 1968, the company has been publishing a magazine called ‘Krishi Jivan’ in Gujarati language, providing agricultural technology updates for farmers. Some of the company’s industrial products include Caprolactam for Nylon-6 production, Gujlamine for methanol, and Argon Gas.

In terms of the company’s stock, GSFC has a promising future. Its share price targets for 2030 are projected at ₹ 661.55 for the 1st target and ₹741.67 for the 2nd target. With a long history and solid market value, the company enjoys a good promoter holding capacity of 38.2%, attracting many reputable investors. Additionally, GSFC exports its products globally and operates farm centers abroad, resulting in a significant Foreign Institutional Investor (FII) interest ranging from 16% to 17%.

| 2030 | Target 1 | Target 2 |

| January | 548.06 | 638.01 |

| February | 553.09 | 644.76 |

| March | 563.23 | 653.97 |

| April | 574.04 | 661.00 |

| May | 583.65 | 673.01 |

| June | 595.99 | 685.87 |

| July | 607.64 | 694.34 |

| August | 620.31 | 703.54 |

| September | 629.09 | 711.11 |

| October | 640.45 | 722.15 |

| November | 653.23 | 731.00 |

| December | 661.55 | 741.67 |

READ MORE: IRFC Share Price Target 2023, 2024,2025,2026 and 2030

GSFC Share Price Target 2040:

In 1969, the company started a laboratory to test soil and water for research. They wanted to find out which nutrients are important for different types of soil. Later, the company began focusing on eco-friendly technology. They built a big wind power project in the Saurashtra area, producing 152.8 MW of power. The company told its research and development team to keep working on new ideas and technology to make the company better. The company predicts its share price based on its performance and market conditions. For example, they expect the share price of GSFC to reach ₹3200.13 and then ₹3425.31 in the future.

The company also started a big project in Dahej. They built a plant that makes fertilizer and other chemicals. They spent ₹9000 Crore on this project. Over the years, the company’s profits grew. They measured this using a number called Return on Equity (ROE). It was 7.25% five years ago, then it went up to 9.23% three years ago, and last year it was 46.12%. They spent ₹7,923.56 Crore on expenses in March 2022, which increased to ₹9,978.23 Crore in March 2023. Their tax payment also went up from ₹329.23 Crore to ₹418.56 Crore during the same time.

| 2040 | Target 1 | Target2 |

| DEC | ₹3200.13 | ₹3425.31 |

GSFC Share Price Target 2024, 2025, 2026, 2028, 2030, 2040

| Year | Target 1 | Target 2 |

| 2024 | ₹317.33 | ₹310.11 |

| 2025 | ₹380.90 | ₹383.87 |

| 2026 | ₹442.71 | ₹446.32 |

| 2027 | ₹507.98 | ₹511.43 |

| 2028 | ₹464.15 | ₹563.08 |

| 2029 | ₹476.77 | ₹580.29 |

| 2030 | ₹661.55 | ₹741.67 |

| 2040 | ₹3200.13 | ₹3425.31 |

GSFC Share Pros:

- Research and Development Focus: The company’s commitment to research and development, as seen in its soil and water testing laboratory and emphasis on new technology, can lead to innovations and improved products or services.

- Eco-Friendly Initiatives: Building a wind power project demonstrates a commitment to sustainability and reducing carbon emissions, which can enhance the company’s reputation and appeal to environmentally conscious consumers.

- Diversification: Investing in projects like an integrated fertilizer and petrochemical complex can diversify the company’s revenue streams and reduce dependence on any single product or market.

- Profit Growth: The increasing Return on Equity (ROE) indicates improving profitability, which can attract investors and strengthen the company’s financial position.

GSFC Share Cons:

- High Investment Costs: While investments in new projects can be beneficial in the long run, they also require significant upfront capital, which can strain finances and increase debt levels.

- Market Dependency: Share price forecasts depend on market conditions, which can be unpredictable and volatile, leading to uncertainty in achieving targets.

- Regulatory Risks: Operating in industries like petrochemicals may expose the company to regulatory changes or environmental regulations, which could increase compliance costs or restrict operations.

- Expense Growth: The increase in expenses over time, especially at a faster rate than revenue growth, could indicate inefficiencies or cost management challenges within the company.

Peers of The Gujarat State Fertilizer & Chemicals Limited

- Chambal Fertilisers & Chemicals Ltd.,

- Madhya Bharat Agro Products Ltd

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd

- Southern Petrochemicals Industries Corporation Ltd.,

- Madras Fertilizers Ltd. and

- Deepak Fertilisers & Petrochemicals Corporation Ltd.,

- Krishana Phoschem Ltd.

- National Fertilizers Ltd.,

- Rashtriya Chemicals & Fertilizers Ltd.,

- Paradeep Phosphates Ltd.,

Conclusion:

In conclusion, the company’s initiatives in research and development, eco-friendly projects, and diversification efforts demonstrate a proactive approach towards growth and sustainability. Despite facing challenges such as high investment costs, market dependencies, and regulatory risks, the company has shown promising signs of profitability and market forecasting capabilities. Moving forward, managing expenses effectively and addressing tax burdens will be crucial to maintaining financial stability and maximizing shareholder value. Overall, the company appears poised for continued growth and success, provided it navigates the challenges effectively and capitalizes on its strengths.

Disclaimer

Dear readers, the information provided in this article or on the website is only for educational purposes. Investing in any stocks or assets carries risk of loss. Please seek the advice of a certified financial expert before making any investing decision. Harveermoney.com is not responsible for any type of loss.

FAQ

Is it good to invest in GSFC?

The company has continuously maintained an upward trend, and according to Anylysists, GSFC has recommended a strong buy.

Can I buy GSFC shares?

Yes, you can easily buy GSFC shares by creating a Demate account. You can buy through a stock exchange or a brokerage platform. Here are some

Angel one

Grow

Zerodha

Is GSFC debt free company?

Company has yeald the Dividend of 4.43% and is almost dedit free

Is GSFC a Government company?

Yes, Gujarat State Fertilizers & Chemicals Limited (GSFC) is a government company and was founded in 1962.

What is the price target of GSFC in 2025?

In the last 3 years, the company has jumped by 136.12%, but in the last year, it dropped to 45.23%. In 2024, the GSFC share price target is set at ₹317.33 for the first target and ₹310.11 for the second target.